Moving a boulder

Getting trust signals into the service provider selection step of a marketplace

TL;DR

-

Context: Two-sided marketplace where homeowners hire providers; selecting unknown providers is a high-trust moment, and our UI + review system wasn’t supporting the key trust signals well.

-

Goal: Improve selection confidence & marketplace trust by (1) understanding how customers select providers, (2) fixing review collection so it’s useful for homeowners + fair for providers, and (3) getting enough buy-in to actually ship distance + review improvements.

-

My role: Owning end-to-end: Spotted the opportunity across studies, built the business case + stakeholder alignment, led discovery, presented company-wide, added quant validation for leadership buy-in + partnered with product teams to translate insights into changes.

-

Method: Mixed methods: ethnography interviews across both sides of the marketplace + targeted high-n quant survey.

-

Data: 7 homeowner interviews (~60 min), 4 partner interviews (~30 min); survey N=852 homeowners with 3 targeted questions.

-

Outputs: Business case + opportunity framing; interview study plan + analysis + insights; company-wide presentation; quant proof; design guidance.

-

Impact: Review collection flow overhauled + distance implemented in the provider selection step, designed to increase trust and value for both sides.

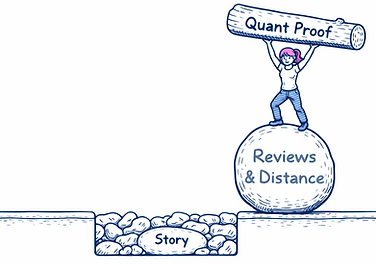

This project felt like moving a giant boulder that everyone agreed should move… but it kept getting stuck. Not because one person wasn’t pushing hard enough — but because there were three obstacles in the way. The idea: clear the path, then the boulder finally moves.

-

Hear the signal in the noise → turn scattered research fragments into a clear opportunity

-

Close the empathy gap → help stakeholders actually feel the homeowner uncertainty and

the partner fairness angle. -

Provide proof in hard numbers → get quant proof so management can confidently prioritize.

Project steps

1. Turning repeated signals into an opportunity

What was happening?

In a two-sided marketplace homeowners need trust, providers need fairness - and selection is the highest-risk moment.

I kept hearing the same thing across smaller studies: choosing an unknown provider online is a trust problem. People want simple confidence signals, especially distance and review-based, and we weren’t supporting them well. Additionally, the review collection system itself had structural issues.

My business case wasn’t just “we should show reviews.” It was: our current system asks the wrong things at the wrong time, allowed for inaccurate reviews, and inconsistent score calculation, meaning we weren’t only missing value, we were risking trust.

.

What I did - and why

Because it wasn’t on the roadmap, I treated it like a mini internal startup:

-

Did deep desk research: where/when/how we collect reviews today

-

Talked to UX leads, PMs, designers, category managers to map blockers + incentives (and build momentum while doing it)

-

Wrote a business case with first steps (“low hanging fruits”), effort/timing/resources, and risks

-

Submitted it… twice

Outcome: Management eventually prioritized the work high enough to start a proper discovery. This was a big win, because we didn’t normally get green light for extensive interviews.

2. Deep discovery: Review journey ethnography

What was happening?

We needed to stop guessing and actually understand:

-

how homeowners use reviews and other selection criteria in the provider selection step (and what makes them trust/distrust)

-

how review collection works (or fails) after the job

-

how providers experience reviews (fairness, pressure, incentives, risk)

.

What I did - and why

I designed and ran a deep discovery ethnography focused on the full review lifecycle, selection and leaving a review afterwards - along the complete project journey with both sides of the marketplace.

Method:

-

7 homeowners, ~60 min interviews

-

4 providers, ~30 min interviews

-

remote, moderated

-

analysis: affinity and user journey mapping

Outcome: In total this was roughly 600 minutes of recordings and 100+ journey-level insights.

3. Closing the empathy gap company-wide

What was happening?

Even with a solid opportunity framing, I kept feeling that people didn’t fully get it yet, especially the emotional part: homeowner uncertainty and the partner fairness tension. And without empathy, “obvious” improvements stay stuck forever.

What I did - and why

I intentionally ran the share-out like a user documentary:

~40 minutes of pure user voice, with me mostly guiding and connecting dots. It was a 60-minute session for the whole company:

-

70+ attendees, including management

-

Chat was super active (emojis, reactions, “oh wow”),

and you could feel a wave of empathy.

I balanced the message on purpose:

-

“Here’s what we already do well”

(so it doesn’t feel like blame) -

“Here are our biggest opportunities"

(distance + a healthy review database)

Outcome: This succeeded where earlier convincing attempts didn’t. Empathy did what arguments couldn’t.

4. Providing hard numbers for leadership buy-in

What was happening?

The qualitative insights gave depth, but I knew that leadership would need quantitative data to make it undeniable - and scale to confidently prioritize and act.

What I did - and why

We already had a big homeowner survey coming up (mostly about other management questions). So I “snuck in” 3 targeted questions to validate key outcomes from the discovery.

Survey:

-

Online survey, N=852 homeowners, ~20 min

-

Sample was representative of homeowners in Germany

-

Key question: “Imagine you are searching online for a provider, which two criteria are most important for your selection?”

Results - major selection drivers:

-

Proximity = #1 (62%)

-

Online reviews = #2 (42%)

-

We also asked about personal recommendations, but focused on the signals that we can directly support in-product.

Outcome: When I shared these results with management, suddenly it turned into: “Ah, if this is the case… then we need to act on this. Let’s meet next week.”

5. Designing & shipping the improvements

What shipped?

Two concrete outcomes tied back to the research:

Impact Example 1: Review collection flow overhaul

Based on the interview insights, we redesigned the review collection flow and improved timing of review request - iterating closely with designers.

Goal: designed to increase review completion rates, data review quality, and a fairer process for partners (in progress).

-

e.g. the homeowner insight "Homeowners search reviews for their key criteria" (+ the uncovered criteria: timely execution, reliability, etc.) informed the decision to

=> collect key highlights with the review, to be able to display them as tags/filter in the provider selection

-

e.g. the provider insight "Bad timing can turn reviews into pressure" revealed that the collection request time window must not overlap with negotiation time.

=> moved the collection window from 2 weeks

to 2-4 months after inquiry

Impact Example 2: Provider distance display in selection step

Distance to the company was implemented so homeowners can see it when making their choice. Once enough reviews would be collected, also reviews would be displayed.

Outcome

-

secured roadmap alignment across product teams

-

resolved fairness concerns for providers by addressing timing and score logic issues

-

shipped distance in selection flow;

review request redesign in progress -

next step: evaluate post launch & iterate the review prompting/timing

Happy End?

... kind of, because marketplaces are never “done”.

The boulder moved — not (just) because I pushed harder, but because I cleared the path:

-

I turned repeated fragments into a focused opportunity (rock heap → shovelled away)

-

I created an empathy moment that unlocked alignment (gap → filled with story "rocks")

-

I backed it with numbers so leadership could act

(tree trunk barrier → lifted)

And that led to shipping the two trust signals that matter most in online selection of unknown providers: distance, and a healthier, fairer review collection process.